IRA Tax Credits & Rebates Guide

What is the Inflation Reduction Act (IRA)?

The Inflation Reduction Act is a United States federal law passed in 2022 to stimulate the economy by reinvesting in domestic clean energy, among other things. As part of this law, homeowners may receive tax credits and rebates beginning in 2023 that will greatly reduce energy bills and costs when they upgrade to new, energy-efficient appliances and electrical systems.

The tax credits became available on January 1, 2023, and will benefit anyone currently installing new energy-efficient water heaters, heat pumps, and more. Rebates are soon to come at the end of 2023, but are not available yet.

What Does the IRA Mean for You?

There are several types of savings you may obtain in the local area by installing new electric and energy-saving appliances with We Care Heating, Cooling, Plumbing & Electric. Households will benefit from up to $14,000 in savings from rebates for new appliance purchases. Tax credits can be claimed for up to 30% of the cost of new energy-efficient appliance installations or replacements, with limits for each type of appliance. The total cap per year for these types of tax credits is $3,200.

Eligibility for these rebates and tax credits is dependent on the type of appliance. You can’t just install any appliance and apply for the benefits though, appliances must adhere to the guidelines for the tax credit. This is where We Care Heating, Cooling, Plumbing & Electric can help you determine which energy-efficient appliances, like heat pumps, which will help you get your money’s worth.

What is the Difference Between a Tax Credit and a Rebate?

Tax credits are reductions in the amount you pay for your taxes. This is different from a deduction, as it is a credit given to you on a purchase you’ve already made, which lowers the overall cost of your taxes. You would file for a tax credit along with your taxes for the year in which you made the qualifying purchase. So, if you purchased a heat pump HVAC system in 2023, you would include your tax credit claim in your 2023 taxes, filed in 2024.

A rebate is money given back upon purchase of an energy-efficient appliance. The rebates offered through the Inflation Reduction Act will not be available until the end of 2023, but when they are, you will coordinate with the contractor installing the appliance – in this case, the team at We Care Heating, Cooling, Plumbing & Electric – to receive the rebate.

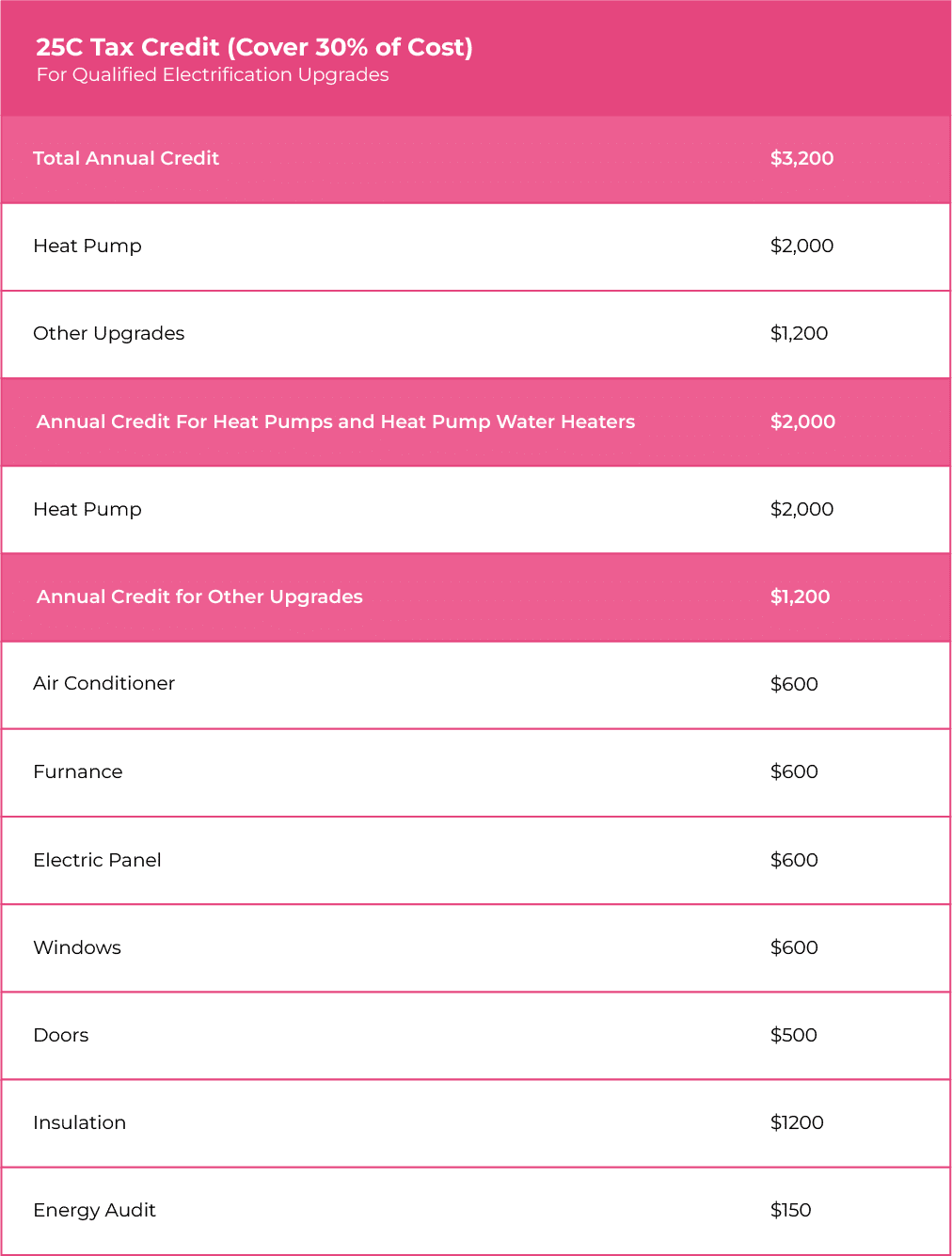

25C Energy Efficient Home Improvement Tax Credit

This tax credit went into effect on Jan 1, 2023. There were previously different guidelines for the credit in 2022, so the following information is only relevant for 2023 and beyond.

How much can I get from the tax credit?

You may receive 30% of efficient appliance purchases, up to $3200 total per year. A full breakdown of the tax credits available by type of appliance are listed in the table below.

Which appliances count for the tax credit?

The appliances eligible for the tax credit include heat pumps, air conditioners, furnaces or boilers and home EV chargers. Other home upgrades, like electrical panel replacements and rewiring, may also apply.

All of these appliances need to meet the conditions set out by the federal government for the tax credit. Appliances should be brand new and fit into the Consortium for Energy Efficiency (CEE)’s highest efficiency tier. New electrical components like a panel upgrade should meet the National Electric Code and have a capacity of 200 amps or more. And finally, heat pumps and boilers should have a thermal efficiency rating of at least 75%.

Am I eligible to receive the Inflation Reduction Act tax credit in Georgia?

The appliances eligible for the tax credit include heat pumps, air conditioners, furnaces or boilers and home EV chargers. Other home upgrades, like electrical panel replacements and rewiring, may also apply.

All of these appliances need to meet the conditions set out by the federal government for the tax credit. Appliances should be brand new and fit into the Consortium for Energy Efficiency (CEE)’s highest efficiency tier. New electrical components like a panel upgrade should meet the National Electric Code and have a capacity of 200 amps or more. And finally, heat pumps and boilers should have a thermal efficiency rating of at least 75%.

How do I claim a tax credit?

The team at We Care Heating, Cooling, Plumbing & Electric will help you figure out the information you need to claim a tax credit for your new energy-efficient appliances.

Rebate Programs

There are two different rebate programs. Both are still rolling out, and are not yet available until the end of 2023. If you plan to buy a new appliance in the near future, keep these rebates in mind.

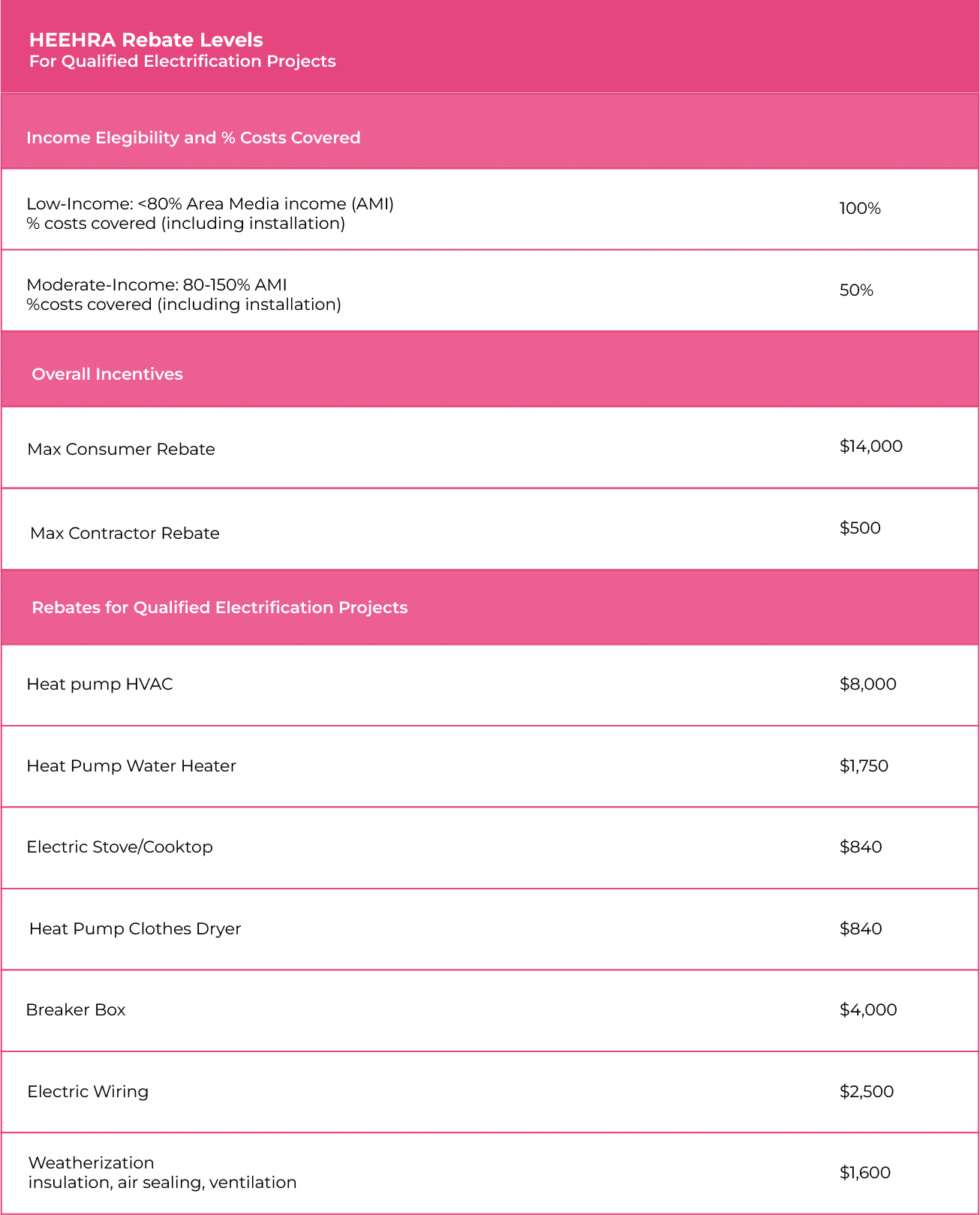

High-Efficiency Electric Home Rebate (HEEHRA)

This rebate program is specifically designed to support low and middle income families who wish to switch to energy-efficient electrical appliances in their homes. It offers families who currently make less than 150% of median household income in the local local Macon-Bibb, Houston, and Peach County area rebates up to $14,000 for these purchases. Families that make less than 80% of the median income will have 100% of the costs for electrification projects covered. This is potentially life-changing for those with out-of-date home appliances who cannot normally afford an upgrade, as these rebates are applied at purchase. Work with a trusted contractor like We Care Heating, Cooling, Plumbing & Electric to ensure you are receiving the proper rebate amount.

To learn about what rebate amount you and your family may qualify for, see the table below.

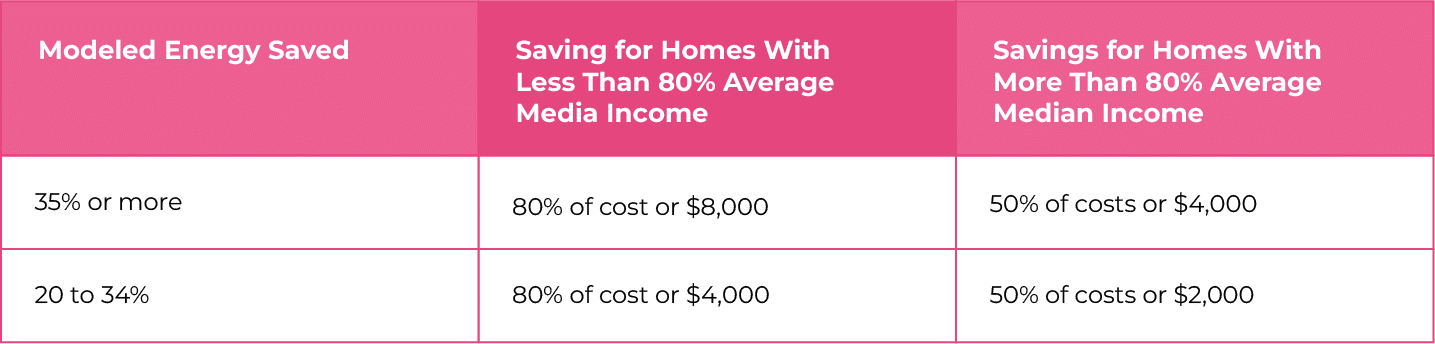

Whole Home Energy Reduction Rebate Program (HOMES)

The HOMES rebate rewards households that seek out home improvements that improve energy efficiency. This includes HVAC installations, insulation upgrades, and more. While the rebate is available to anyone, the amount you will get depends on your income relative to the Georgia area median. See the table below to determine how much you may receive through this rebate, based on the predicted amount of energy your household will save with the new installation.